Our financial planning team recently caught up with strategists from JP Morgan to discuss the outlook for the remainder of the year given the current economic climate.

Key Points from the Meeting

- Weak growth and banking sector stress could persuade the Fed to consider lowering rates before year-end, despite still elevated inflation

- Other developed market and Asian central banks are also approaching peak rates, but may not be in a rush to ease

- Should rates drop, JP Morgan’s investment outlook will consist of longer-term fixed income and focusing on high quality, defensive stocks

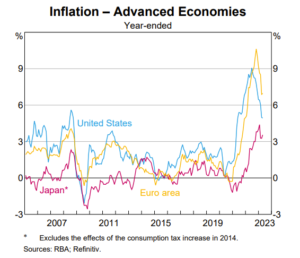

At the start of the year, it was expected that 2023 would be more challenging for central bankers around the world. Instead of raising rates aggressively to cool inflation against a strong economic backdrop, they now need to balance their monetary policy between stubborn inflation and a greater risk of economic recession and financial sector shocks.

A sign that rate rises will continue to slow, and perhaps start coming back down, is that the cash rates are now hitting their peak predicted policy rates from the forecasts back in March. Additionally, there are growing signs that the economy is slowing with lending tightening and becoming more difficult.

The unemployment rate continues to be solid and household spending is still in good shape. However, a reduction in corporate spending and a weaker housing market places pressure on the Fed to start bringing rates down, even if inflation is slow to come down.

JPMorgan analysts expect rate cuts to start becoming evident around September for the US market. This expectation could be built upon previous rate cycles where the average period of the last hike to the first cut is around 6 months. That being said, historical precedents may be less applicable now with inflation still being the top priority for the Fed.

In summary, it can be expected that rates will start to wind back down towards the end of the year, and it will likely result in weaker growth. From an investment perspective, this means longer-term fixed income products, high quality stocks and defensive sectors are expected to outperform after a few years of poorer returns.

Written by Jackie Crane.