Over the past decade and a half, we have moved to a globalised, internet and smart phone-enabled, world. The market has become a globalised “winner takes all market”.

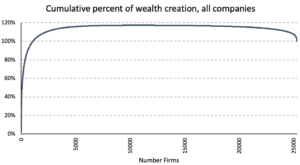

Power law probability distributions describe the situation where only a small percentage of a certain population produce most of the value. This type of probability distribution is also known as a Pareto Distribution. A common example is the “80-20” rule where 80% of the value is produced by 20% of the population. Even before the emergence of the internet, returns for global equity markets had been dominated by a small group of highly successful businesses. Most listed stocks produce unattractive long-term buy and hold returns. In a study of the returns produced by U.S. equities from 1926 to 2016, Hendrik Bessembinder (2018) finds an extremely narrow group of stocks drove all of the equity market returns. The top-performing 1,092 listed U.S. companies (or 4.31% of the total number of listed stocks during this time period) accounted for all of the wealth creation from investing in equities (i.e. excess equity returns relative to treasury bills). Bessembinder (2019) replicated this study across 42 countries over the 1990 to 2018 period and found the returns globally were even narrower where the best performing 811 firms (or 1.33%) accounted for all the net global wealth creation.

Stock market returns over the long term are not driven by most stocks but rather by a small number of structural growth businesses. The extraordinary returns from this small number of structural growth businesses result in the market’s return distribution having a positive skew rather than a normal bell curve shape. It is the compounding impact of high return structural growth businesses (“the winners”) that drive most stock market returns over the long term. Unless a long-term “buy and hold” investor can successfully select future structural growth companies, that is, the structural winners, and give them sufficient weight in their portfolio they will not produce excess returns.

Bessembinder (2018) provides evidence that long-term market returns are driven by a narrow number of long[1]term winners. The following charts clearly show how narrow the number of companies are that contribute to equity returns from 1926 to 2016 in the U.S. market. The super-abnormal returns of a select few businesses compensate for many losing or average performers:

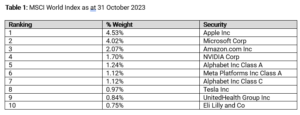

The creative destruction of capitalism means there are few winners. The world continues to migrate to a winner-takes-all model where average and below average companies continue to suffer from low industry demand growth and a structural decline in the relative strength of their value proposition to customers. We believe the return and performance profile of a select group of quality growth companies will persist. With the largest 5 companies in the MSCI World between 1.0% to 4.5% of the index each, some of these will become much larger components over the next decade. Market capitalisations of many trillions of dollars will become reality for the largest listed companies in the world over the next decade and beyond.

Value creation within capitalism is rarely linear and a long-term view is required. To maximise compound returns, we believe investors need to hold a small number of structural growth stocks for long time periods, generally many years to decades. We believe that true risk relates to permanent loss of capital or destruction of capital. Share price volatility is not risk. A sustainable business model is essential for earnings to compound over time. Investment should focus on qualitative elements such as value proposition, competitive advantage, strength of business model, recurring level of revenue and strength of balance sheet to ensure we have selected businesses that can survive permanently.

Conclusion

The fact that long-term cumulative equity returns are driven by a small number of exceptional equities does not mean the odds of success are necessarily low. Most experienced investors have some ability to recognise a few good investment ideas over the long term. By investing in a relatively concentrated number of high quality growth businesses, being patient and holding these businesses over the long term, investors can focus on their best investment ideas and benefit from the compounding growth in their value. This is an extremely powerful and effective approach to wealth creation. Over the long-term share prices follow organic sales growth per share and earnings per share growth. Hence stay disciplined and focused on the highest quality businesses – the structural winners.